XRP‘s price prediction for August 9 presents a complex picture with mixed signals as large holders appear to be quietly exiting while technical patterns hint at potential upside. Notably, the recent XRP whale activity indicates substantial selling pressure. However, optimism remains as the outcome of the Ripple SEC case and the formation of a bullish flag pattern could set the stage for an explosive breakout to $10 in the upcoming weeks.

XRP Whale Moves, SEC Outcome, and the $10 Bull Flag Setup

Major Whale Exits Are Creating Market Shift

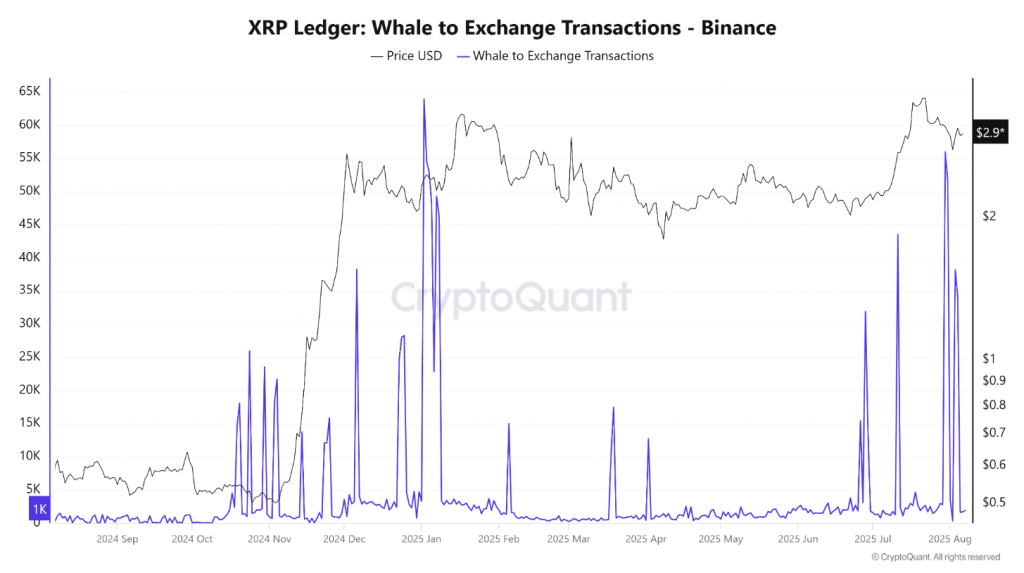

As of August 9, XRP’s price dynamics are heavily influenced by significant whale selling that began in late July. Insights from the XRPL Whale Flow metric reveal a notable downturn, starting with a net outflow of approximately -$54 million on August 1, and easing to around -$43.7 million by August 7. This trend indicates shifting market fundamentals as the actions of large holders trigger broader price movements in the cryptocurrency.

The surge in whale transactions sending XRP to exchanges peaked at over 51,000 on July 31 and has maintained elevated levels, remaining above 38,000 until August 4. This activity mirrors historical trends, previously leading to significant price declines such as the 50% drop from $3.40 to $1.60 earlier this year. However, there’s a possibility that whales may have finished liquidating their positions, hinting at a potential rebound for XRP.

Technical Setup Points to Potential Bull Flag Breakout

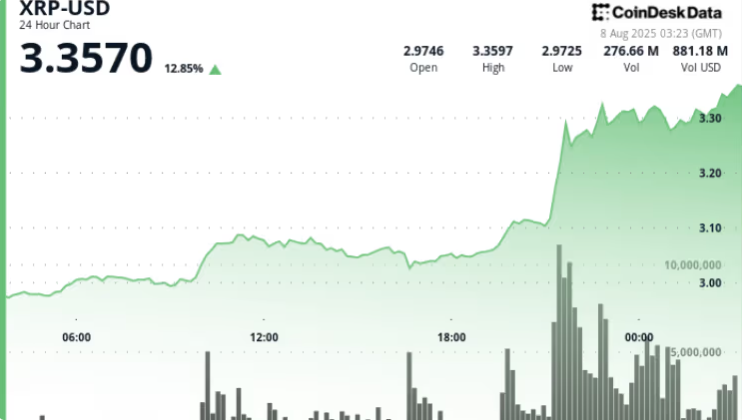

Despite the heightened selling pressure from whales, current technical indicators suggest XRP is forming a bullish flag pattern on the daily charts. This formation originates from a flagpole that reached approximately $3.60 before consolidating, holding critical support at $2.65 and resistance at $3.38. A breakout above the resistance level could propel XRP towards the $10 mark, aligning with projections from various analysts.

Market dynamics suggest that a $10 breakout is feasible if the bull flag activates above the $3.55 resistance level. The projected movement derived from the flagpole hints at a surge towards the $8-10 range, coinciding with multiple analysts’ forecasts for this market cycle.

Recent activity reported by market intelligence platform Santiment supports this optimism: “The number of interacting XRP addresses has averaged over 295K daily over the past week, far exceeding the usual daily average of 35-40K seen in the last three months. Moreover, there are now over 2,700 whale and shark wallets holding at least 1 million XRP for the first time in the asset’s 12-year history.”

SEC Case Resolution Timeline Remains Critical

XRP’s trajectory leading into August 9 is heavily influenced by the upcoming SEC status report scheduled for August 15. The resolution of the Ripple SEC case stands to alleviate ongoing regulatory uncertainty, which has hampered institutional adoption since 2020.

Legal analysts anticipate that a resolution could occur within two weeks of the August 15 filing. Former SEC attorney Marc Fagel pointed out that a favorable settlement hinges on the SEC approving the lawsuit’s dismissal, which may release the $125 million civil penalty currently held in escrow.

Also Read: Japan’s SBI Files XRP/Bitcoin ETF as 80% of Banks Adopt Ripple Tech

Institutional Interest Builds Despite Current Volatility

Even amidst whale selling, XRP’s outlook remains buoyed by increasing institutional adoption. Several ETF applications from Grayscale, Bitwise, and Franklin Templeton are awaiting SEC approval, with Polymarket odds marking a favorable 93% for spot XRP ETF approval by year’s end.

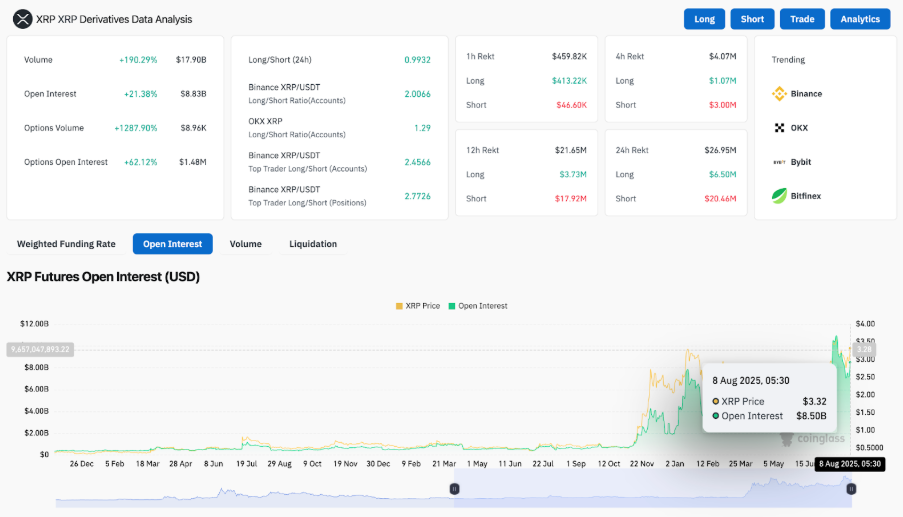

XRP futures open interest has surged to $8.53 billion, reflecting a 21.38% increase from previous levels. Moreover, options volume has skyrocketed by over 1,300%, predominantly focused on call options with strike prices between $4 and $10, indicating that traders are gearing up for significant upside movement.

Additionally, companies like Nature’s Miracle Holding have disclosed a $20 million XRP treasury position, while Brazil’s VERT has issued an impressive $130 million in tokenized credit on the XRP Ledger, underscoring the real-world adoption the asset is experiencing.

Also Read: SEC Ripple Decision Officially Ends Years-Long Fight, XRP Price Jumps

As the landscape rapidly evolves, XRP’s price prediction on August 9 reveals a critical juncture dominated by whale activity, technical formations, and potential regulatory clarity. The interplay of these factors offers numerous catalysts for a breakout towards the $10 threshold, positioning XRP at an exciting crossroad in the market.