LINK Sees Increased Whale Activity Amid Price Decline

Despite a significant price drop in recent days, LINK, the native token of Chainlink, continues to attract the attention of both individual investors and larger players, commonly referred to as ‘whales.’ On February 18, 2025, a notable crypto expert shared on X (previously Twitter) that in light of the recent decline, crypto whales have purchased over 1.10 million LINK tokens within just 24 hours. This influx of whale activity underscores the persistent interest in LINK, even as the cryptocurrency market experiences volatility.

LINK Current Price Momentum

In conjunction with substantial purchases by whales, LINK has experienced a notable downturn, with its price dropping more than 10% in a short time frame and currently trading around $17.50. This price fluctuation is compounded by a 20% increase in trading volume, indicating heightened engagement from traders and investors seeking to capitalize on the shifting conditions. The juxtaposition of falling prices with rising trading activity raises questions about market sentiment and future movements for the token.

LINK Technical Analysis and Upcoming Levels

As LINK navigates this challenging price environment, technical analysis points toward a bearish outlook. Early February 2025 marked a critical moment as LINK broke below its significant support level of $20, subsequently consolidating in a tight range beneath that threshold. This downward momentum has breached the consolidation zone further, signaling potential for additional downside.

Currently, LINK’s price has dipped below the 200 Exponential Moving Average (EMA) on the daily chart, a strong indication that the asset is transitioning into a downtrend. Analysts suggest that should LINK close a daily candle beneath the $17.45 mark, it could trigger a reduction of 15%, potentially bringing the price down to around $14.75 in the near term.

Short Sellers Take Control

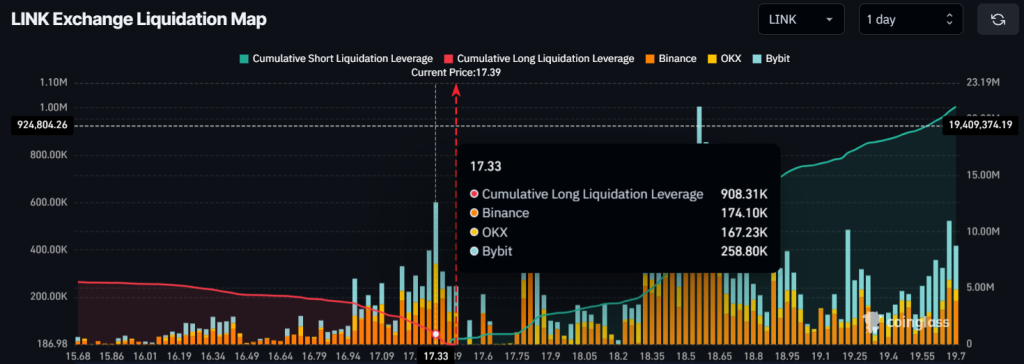

As bearish signals consolidate, short sellers are capitalizing on LINK’s decline. Reports indicate an increase in open short positions, with traders betting against a near-term rally. Insights from on-chain analytics firm Coinglass reveal that long positions are currently over-leveraged at around $17.33, with nearly $1 million in total investments. In contrast, traders holding short positions are significantly more leveraged at $18.56, amassing nearly $10 million in bets against the token.

The trend suggests that traders are wary of LINK surpassing the $18.56 level, indicating a prevailing sentiment that keeps the market under the influence of bearish positions. Coupling these on-chain metrics with technical analysis paints a vivid picture of current market dynamics, suggesting that bears hold the reins as LINK may be heading for a consequential price drop.