The current volatility in the cryptocurrency market has left traders and investors bewildered, leading to significant shifts in market sentiment. Among the notable tokens experiencing these changes is XRP, the native asset of Ripple Labs, which appears to be heading toward a price decline as bearish sentiments gain traction among crypto enthusiasts.

70 Million XRP Dump Onto Exchanges

Recent reports have highlighted a concerning trend: crypto whales have collectively dumped over 70 million XRP tokens onto exchanges within the last four trading days. This massive sell-off was noted by a well-known crypto expert on X (formerly Twitter), capturing the attention of market participants and stirring anxiety across the XRP community.

Dumping such a large volume of XRP is typically viewed as a bearish signal by market analysts, implying increased selling pressure that could pave the way for a notable decline in the token’s price. Unfortunately, such sentiments are reflected in XRP’s current market performance.

Current Price Momentum

As it stands, XRP is trading at approximately $2.97, representing a decline of over 4.45% in the past 24 hours. Despite this notable downturn, the trading volume has remained relatively stable, suggesting that the market’s volatility is not accompanied by significant alterations in trading activity.

XRP Technical Analysis and Key Levels

From a technical perspective, expert analysis indicates that XRP has been moving within a descending parallel channel on a daily timeframe. Recently, it has formed a bearish engulfing candlestick pattern, which is frequently associated with impending price drops. Analysts predict a likely decline of more than 8.5%, potentially taking XRP to a support level around $2.75.

Despite this bearish representation, XRP has managed to remain above the 200 Exponential Moving Average (EMA) on the daily chart, suggesting that, overall, it might still be in an uptrend, albeit tempered by the prevailing market conditions.

Traders’ Bearish Outlook

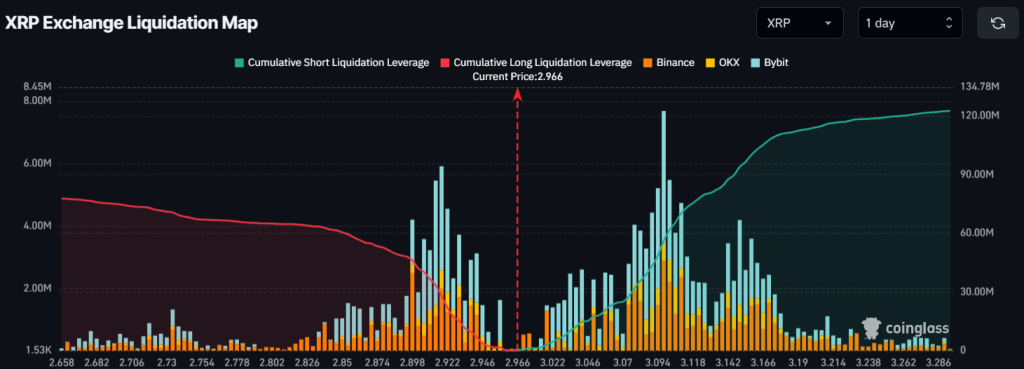

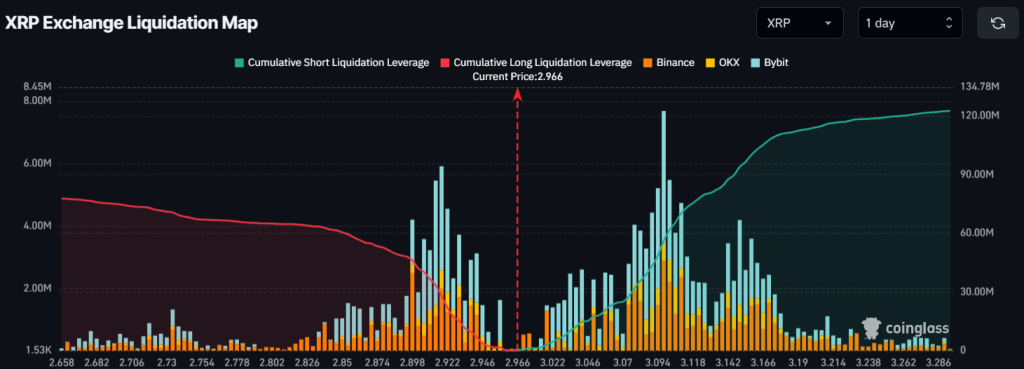

Market data indicates a significantly bearish sentiment among traders regarding XRP’s price action. According to CoinGlass, bulls currently have over-leveraged long positions valued at $28 million around the $2.91 level, while short sellers dominate with $56.30 million in short positions at the $3.10 level. This imbalance illustrates a distinct bearish tilt in the market sentiment.

This disparity suggests that short sellers are firmly in control of the market. Should XRP’s price dip below $2.91, it could lead to a ripple effect, triggering liquidations of bullish positions and further amplifying the downward momentum in XRP’s pricing dynamics.