What’s $63K ETH Price Target Truth? Tom Lee Ethereum Prediction Logic

Wall Street expert Tom Lee has sent shockwaves through the crypto market with his bold ETH price prediction. Can you believe a projected $400 trillion market cap for ETH? Well, he certainly does.

Not only that, but his latest Ethereum forecast suggests the coin could soar past $63,000. So, what fuels his confidence?

It all boils down to tokenization. Currently, the asset is valued at around $440 billion, while the total global markets are worth about $300 trillion. Major financial institutions, like BlackRock led by Larry Fink, are eager to tokenize these assets and put them onto the blockchain. If even a fraction of this enormous market migrates to the Ethereum network, Tom Lee’s $63,000 price prediction could materialize.

Bitmine Immersion Tech Goes All-In: Reason Behind Bullish Setup

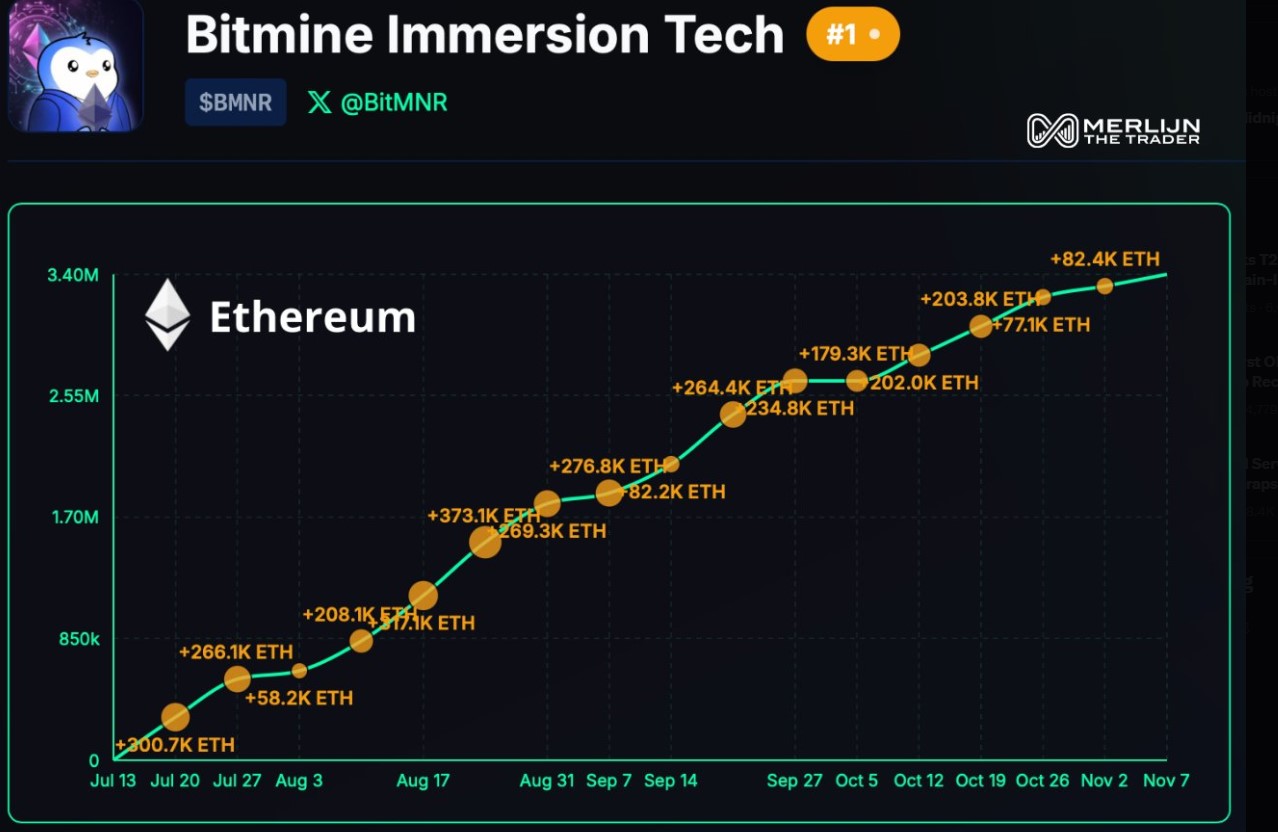

Supporting this optimistic outlook is Bitmine Immersion Tech, a significant player that’s investing heavily in Ethereum. As noted by Merlijin The Trader on November 7, Bitmine has amassed an impressive 3.4 million ETH tokens, which accounts for 2.8% of all Ethereum in existence.

The company has been consistently buying since mid-July, increasing its reserves from about 300,000 tokens. This isn’t just a typical whale play; it represents a strategic commitment to the coin’s infrastructure, staking, and mining capabilities.

This steady accumulation and long-term vision illustrate why Tom Lee’s Ethereum prediction remains buoyant.

ETH Price Analysis: Resting Before The Big Climb

Currently, Ethereum is trading at $3,367.06, experiencing a 2% increase in the last 24 hours. However, trading volume has dropped by 25.36% to $30.63 billion.

-

Price Action: The token is experiencing a pause after rising from the $3,200 level.

-

Technical Indicators: The RSI is neutral between 39–50, while the MACD indicates a minor bearish crossover, suggesting short-term weakness.

-

Analyst Perspective: Ali Martinez has a roadmap in mind: first a target of $2,000, then aiming for $10,000.

While technical indicators present a mixed picture, the fundamentals surrounding Tom Lee’s ETH price target and Bitmine’s investments remain incredibly bullish. From my analysis as a crypto strategist, this could be an opportune moment for traders to consider entry, as significant bullish price catalysts loom ahead.

Inside Tom Lee Ethereum Prediction: The Road to $63,000 Price

This forecast hinges on a fundamental shift in global finance, setting the stage for a significant price rally for Ethereum. Let’s break down the potential trajectory.

-

Short Term (2025 Q1–Q2): Ethereum could test resistance in the $3,800–$4,200 range, with potential small price drops if Bitcoin’s dominance wavers.

-

Mid Term (2025–2026): Should large buyers continue their accumulation strategies, a rally to $7,500–$10,000 becomes plausible, aligning with Ali Martinez’s expectations.

-

Long Term (2028–2030): If tokenization spreads globally and Ethereum captures 1-2% of all global assets, Tom Lee’s prediction of $63,000+ could be reached by 2030.

The convergence of Tom Lee’s insights, Bitmine’s substantial holdings, and the transformative potential of tokenization sets a robust foundation for Ethereum’s next price surge.

Disclaimer: This article is for informational purposes only. Always conduct your own research (DYOR) before buying or selling any asset, as cryptocurrency carries inherent risks.