Latest Crypto Market Update: STBL Coin Price, Google AI Payments News

The global cryptocurrency market continues to showcase resilience, with the market cap currently standing at $4.15 trillion, reflecting a 1.3% increase in just the last 24 hours. This surge in market cap is accompanied by a robust trading volume that reached $139 billion, indicating strong activity among traders and investors.

Bitcoin, the leading cryptocurrency, maintains a dominance of 56.1%, while Ethereum follows with 13.1%. As of now, the total number of cryptocurrencies tracked has reached an impressive 18,784. Today’s noteworthy gainers include the Polkadot Ecosystem and the XRP Ledger Ecosystem, both of which are experiencing significant price appreciation.

Major Crypto Market Events Today

Source: Forex Factory

24 Hour Crypto Market Update

Bitcoin is trading at $116,661, marking a modest rise of 1.0% over the past day. Its market cap stands at $2.32 trillion, buoyed by a significant trading volume of $40.21 billion.

Among the top trending cryptocurrencies today is STBL (STBL), which has surged by a staggering 329.1% to trade at $0.1269. The trading volume for STBL reached $247.5 million, showcasing strong investor interest. Following close behind, Undeads Games (UDS) posted a 3.9% gain, now priced at $1.79 with a trading volume of $1.07 million. Meanwhile, Pump.fun (PUMP) saw a decline of 7.4% to $0.007857 but remains active with an impressive trading volume of $836.2 million.

Top 3 Gainers: Leading the way is STBL (STBL) with a remarkable 328.5% increase to $0.1253, achieving a volume of $247.8 million. Yala Stablecoin (YU) also made headlines, climbing 128.8% to $0.9419, along with a more modest trading volume of $233,000. Test (TST) rounded out the top three gainers with a jump of 90.8% to $0.05244, supported by a trading volume of $204.7 million.

Top 3 Losers: On the flip side, Unibase (UB) faced a decline of 21.0%, settling at $0.03835 with a trading volume of $41.3 million. OpenxAI (OPENX) dropped by 19.9% to $1.29, backed by a trading volume of $4.28 million, while Avantis (AVNT) fell by 17.8% to $0.9881 despite strong trading activity amounting to $926.6 million.

The overall market cap of stablecoins is currently at $294 billion, showing a slight change of 0.3% in the past 24 hours. Stablecoins are vital liquidity providers in the cryptocurrency ecosystem, evidenced by a high trading volume of $104.64 billion.

Meanwhile, the market cap of the DeFi sector stands at $172 billion, reflecting a slight downward movement of 0.1% in the past day. Daily trading volume in DeFi reached $8.35 billion, holding a 4.1% share of the global cryptocurrency market.

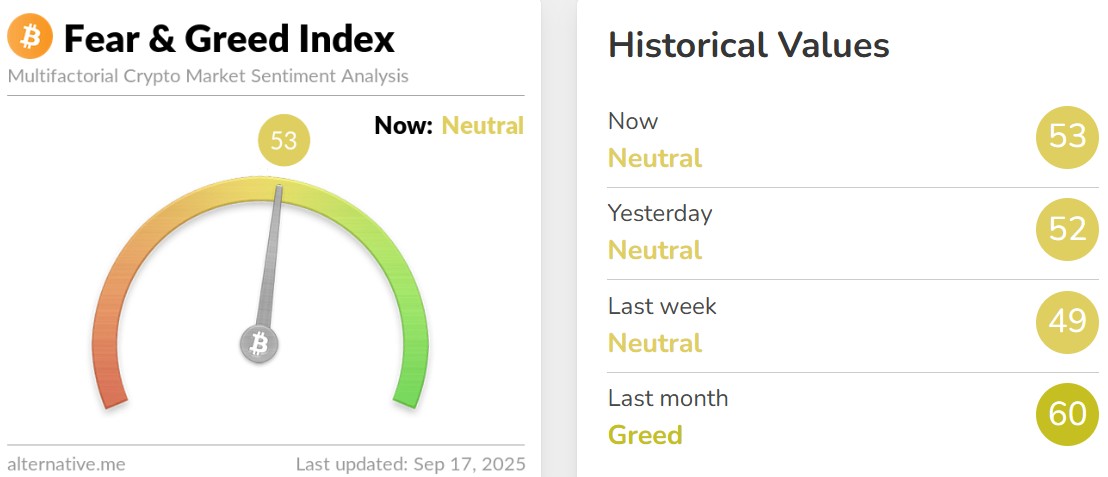

Fear and Greed Index Today

Source: Alternative Me

The Bitcoin Fear & Greed Index is currently at 53 (Neutral), signaling a balanced sentiment among investors. In comparison, yesterday’s reading was slightly lower at 52 (Neutral), while last week’s figure stood at 49 (Neutral). A month ago, the index indicated stronger optimism at 60 (Greed), suggesting that traders have adopted a more cautious stance recently.

Latest Market News Today: September 17, 2025

-

Banco Santander, Spain’s largest bank and Europe’s fourth largest, has launched retail crypto trading through its digital arm, Openbank. Starting Tuesday, clients in Germany will be able to trade Bitcoin, Ethereum, Litecoin, Polygon, and Cardano. This service is set to expand to Spain soon.

-

UBS, PostFinance, and Sygnum Bank have successfully completed the first binding payment using tokenized bank deposits on a public blockchain, as announced by the Swiss Bankers Association. These tokenized deposits can seamlessly move across banks, presenting a new blockchain-based alternative to traditional stablecoins.

-

Binance is currently in discussions with the U.S. Department of Justice concerning the conclusion of the three-year compliance monitor instituted as part of its $4.3 billion settlement in 2023. Decisions on whether the DOJ will require enhanced compliance reporting remain pending.

-

Circle has rolled out native USDC and CCTP V2 on HyperEVM, the high-performance chain within the Hyperliquid ecosystem. Developers, institutions, and traders can now utilize USDC with cross-chain deposits from over 12 blockchains.

-

Stephen I. Miran has officially been appointed to the Federal Reserve Board of Governors, following his nomination by President Trump and Senate confirmation. His term will likely influence upcoming monetary policy direction.

-

Google has introduced a free AI payments protocol that integrates credit cards and stablecoins, developed in partnership with Coinbase, Salesforce, and over 60 additional organizations, including the Ethereum Foundation.

-

SharpLink has repurchased 1 million shares of its $SBET as part of its 1.5 billion buyback program. This buyback brings the total to 1,938,450 shares. The company holds 838,152 ETH valued at $3.86 billion, with 3,240 ETH in staking since June, indicating a solid ETH-focused, debt-free growth strategy.

-

Binance announced its 40th HODLer Airdrop, including Avantis (AVNT) tokens, distributed to eligible BNB holders who subscribed to guaranteed or on-chain earning products from September 6 to September 16.

Disclaimer: Coingabbar provides informational content on cryptocurrencies, NFTs, and other decentralized assets. This is not financial advice. Users are encouraged to do their own research (DYOR), understand the risks, and consult financial professionals before investing. CoinGabbar is not responsible for any financial losses. Cryptocurrencies and NFTs are highly volatile—invest wisely.