- Cardano price correction could extend another 15% before hitting a key support trendline at $0.34.

- Market sentiment weakened following the launch of Cardano’s Midnight Network sidechain.

- The open interest associated with the Cardano futures contract has plunged to $694 million, registering weak participation from market speculators.

ADA, the native cryptocurrency of the Cardano ecosystem, fell 3.58% during Friday’s market hours to trade at $0.41. The selling pressure aligns with broader market pullback as investors react to the Federal Reserve rate cut. Along with macroeconomic jitters, Cardano price faces additional pressure amid technical breakdown, token fallout, and lack of speculative force. Will ADA coins lose the $0.4 floor?

Cardano Under Pressure as NIGHT Token Collapse Spills Into ADA Market

The past few days have been turbulent for Cardano (ADA) as its price has plummeted from $0.482 to $0.409, marking a significant 15.5% loss. This decline mirrors the broader market’s response to the Federal Reserve’s recent actions, which instigated a wave of selling as initial excitement swiftly turned into apprehension.

A notable factor contributing to this slump has been the tumultuous launch of the Midnight Network, Cardano’s privacy-focused sidechain. Its NIGHT token debuted on December 9, 2025, with an initial surge before experiencing catastrophic losses—some exchanges reported drops exceeding 80%. Early adopters, having received tokens through a substantial airdrop, quickly began to sell off, resulting in NIGHT’s fall to a range of $0.03 to $0.05.

This post-launch sell-off has significantly influenced market sentiment, leading many to tread carefully with anything related to Cardano. The implications are clear: increased skepticism toward ADA as traders await more stable developments.

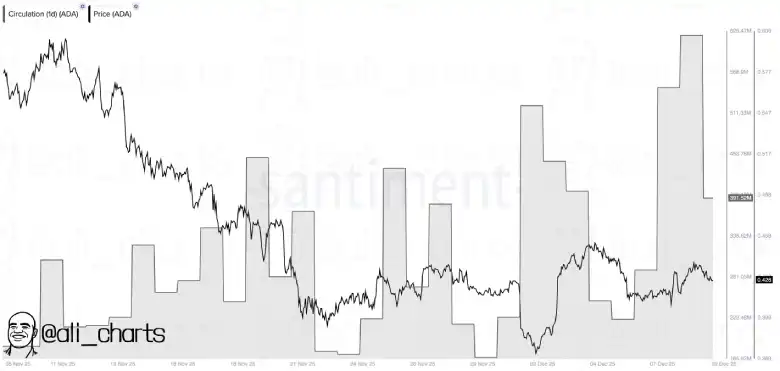

Further compounding these issues, the open interest figures for the ADA futures market have seen a sharp decline from $846.5 million to $694.2 million, according to Coinglass. This drop signifies that traders are retreating from leveraged positions, likely due to the anticipated market volatility, signifying a waning interest from speculative participants.

Historically, similar trading behaviors have led to a decrease in market speculation, thereby reinforcing a bearish trend for ADA’s price.

On-chain data also reveals an increase in the circulating supply of ADA tokens, which is intensifying downward pressure on the price. An expanding supply, especially during a market downturn, raises concerns about the immediate value of ADA, as it poses challenges for price stabilization.

Cardano Price Risks 15% Fall Before Major Support Test

The recent three-day downturn highlights a significant V-top reversal pattern under the 20-day exponential moving average, suggesting that market participants are inclined to adopt a “sell-the-bounce” strategy. The ongoing decline, supported by increasing trading volumes, indicates strong seller conviction—one that has transformed market dynamics.

Technical indicators like the Relative Strength Index (RSI) are showing some bullish attempts; however, the overall trend remains bearish. The formation of lower highs and lower lows suggests that rebounds are rapidly followed by renewed selling pressure, making it difficult for buyers to regain significant momentum.

Should the selling trend continue, ADA’s value could potentially fall another 15% to test a crucial support trendline around $0.34. This trendline has acted as a critical accumulation zone for buyers since June 2023, making it an important point of interest for traders as they look for signs of reversal or continued decline.

If this support is breached, ADA could face considerable selling pressure, marking a new chapter in its market journey.

Monitoring ADA’s price action, especially around the $0.34 mark, will be crucial for traders and investors alike, as this could either prove to be a pivotal reversal point or a precursor to a more extended downturn in the Cardano ecosystem.

Also Read: Ripple Wins Major Federal Banking License from OCC