Binance Coin’s Upward Momentum Above $930

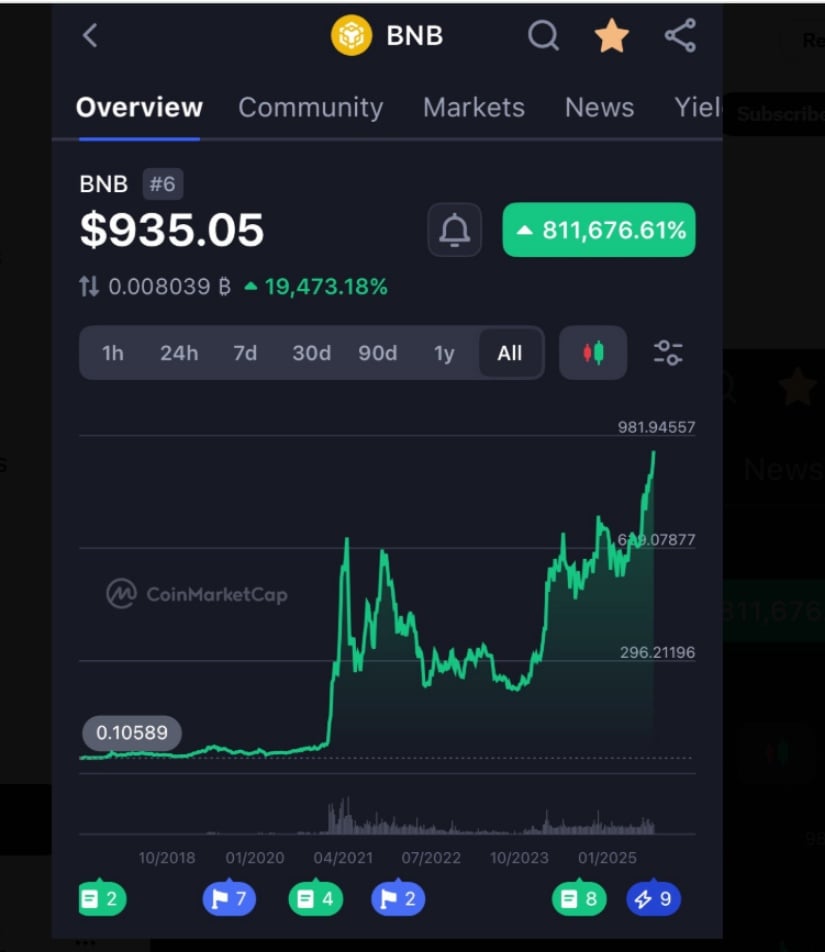

Binance Coin (BNB) has recently captured significant market attention as it continues its strong upward trajectory, hovering above the key $930 mark. Analyst CW has pointed out a critical buying wall near $910, which seems to have effectively absorbed selling pressure and bolstered BNB’s bullish structure. This persistent demand zone has facilitated repeated rebounds, underscoring the cryptocurrency’s potential for significant growth.

The Importance of the $910 Demand Zone

CW’s observations indicate that the buying wall around $910 is more than just a temporary phenomenon—it is a critical support zone that has proven resilient against bearish trends. The four-hour chart reflects multiple higher lows, illustrating sustained market demand, even during minor pullbacks. Should Binance Coin retest this area, it could ignite fresh accumulation, reinforcing BNB’s bullish momentum.

BNBUSDT 4-Hr Chart | Source: x

Analyst Insights: Testing Higher Ground

Analyst legen points to a decisive movement above $935, suggesting that market confidence is on the rise. This upward strength positions Binance Coin to challenge the psychological resistance level of $1,000. With trading volumes increasing and higher lows forming, it appears that investor interest is continuing to climb, paving the way for more substantial price action.

BNBUSDT Chart | Source: x

Potential for Broader Market Participation

As Binance Coin approaches the $1,000 milestone, it’s essential to consider broader market dynamics. Legen notes that this growth aligns with historical trends where capital often flows into larger altcoins like BNB following a stabilization phase in Bitcoin. The increasing trading volumes further bolster expectations, indicating that if a market rally occurs, Binance Coin is well-positioned to capture a share of that momentum.

Current Market Performance and Trading Volatility

At the time of writing, Binance Coin was trading at $932.51, showing a modest gain of 0.09% over the past 24 hours, alongside a market capitalization of approximately $129.76 billion. Throughout the trading day, BNB exhibited intraday volatility, opening near $935, dipping to about $920, and then recovering to current levels. The daily trading volume stands at around $1.18 billion, demonstrating ongoing market engagement despite temporary dips.

BNBUSD 24-Hr Chart | Source: BraveNewCoin

Technical Setup for Continued Uptrend

The prevailing technical setup strongly supports the notion that Binance Coin possesses continued bullish momentum. The consistent buying interest near $910, combined with repeated testing of the $930 area, reflects robust demand capable of absorbing selling pressure. Analysts believe that maintaining this level opens the door for a breakout into the $940–$950 range, establishing a clear path toward the long-anticipated $1,000 threshold.

With stable support levels and sustained trading volume, Binance Coin appears to have built a resilient market structure capable of sustaining its upward advance. If BNB can decisively push beyond the significant $1,000 mark, it would signify a crucial technical breakout, signalling further bullish prospects in the near term.

The cryptocurrency’s ongoing performance and market dynamics are worth watching closely, as they hold significant implications not only for BNB itself but for the altcoin market as a whole. With analyst support and a solid demand base, there’s reason to be optimistic about Binance Coin’s future.