On August 22, BNB price soared to an extraordinary new all-time high of $899.66, sparking excitement and curiosity throughout the cryptocurrency community. Investors and traders are now speculating whether this surge is the precursor to BNB finally crossing the coveted $1,000 threshold, a psychological barrier that many major cryptocurrencies aspire to breach.

This impressive climb culminated in a 6.8% daily rally, boosting Binance Coin’s market capitalization to an astonishing $124.7 billion, reaffirming its status as the fifth-largest cryptocurrency globally. With momentum building, the question on everyone’s mind is: Can BNB maintain this trajectory and ultimately surpass the $1,000 mark?

Driving Forces Behind the Surge

The recent surge in BNB’s price is underpinned by more than just technical indicators; there are significant market forces at play. A noteworthy development is the Nasdaq-listed BNB Network Company (BNC) acquiring 200,000 BNB for $160 million, instantly positioning itself as the largest corporate holder of the token. This strategic acquisition has implications for both demand and market sentiment.

BNC has indicated plans to expand its holdings to 325,000 BNB, mirroring the bold treasury acquisition strategy made famous by MicroStrategy with Bitcoin. This kind of corporate adoption could create a sustained structural demand that counterbalances any potential profit-taking from retail investors.

Moreover, BNB is not in isolation regarding institutional interest. Nano Labs and Windtree Therapeutics have also invested significant sums, $\$90 million and $\$60 million, respectively, into BNB treasuries. This influx of institutional capital serves to solidify the foundational strength of BNB even further.

On-chain data offers additional evidence of BNB’s bullish momentum. The BNB Chain processed an impressive 115 million transactions in the past week alone, marking a 12% increase month-on-month while upholding its ultra-low fee structure, averaging just $0.016 per transaction. Such activity speaks volumes about the chain’s utility and user engagement.

BNB leads in terms of active addresses | Token Terminal

Token Terminal accolades further elevate BNB Chain, which is now recognized as the top blockchain by weekly active addresses, reporting 16.6 million users, exceeding competitors like NEAR and Solana. The daily active wallet count also demonstrates solid performance, with 2.3 million active addresses as of August 21, according to BscScan.

In addition to organic transaction growth, Binance’s HODLer Airdrops program is catalyzing fresh demand for staking. The recent distribution of 150 million PLUME tokens to BNB stakers has further reinforced staking lock-ups, acting as a potential liquidity sink while also echoing trends seen in previous cycles, which often preceded significant price movements.

Technical Analysis: Aiming for $923 and Beyond

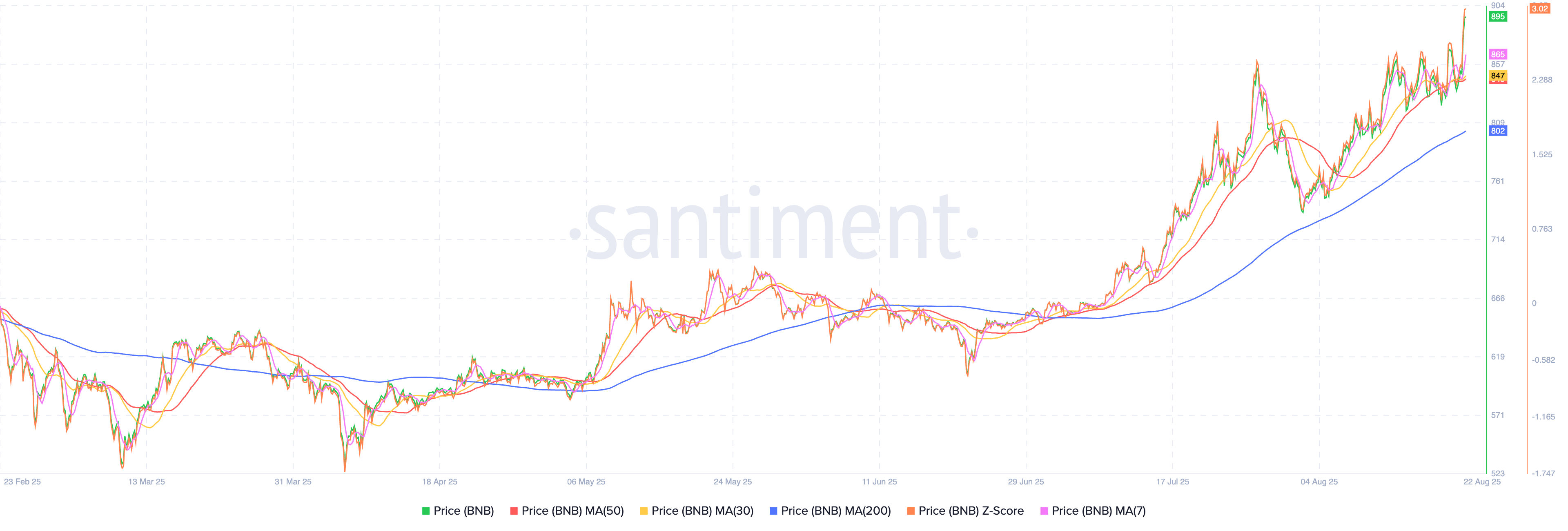

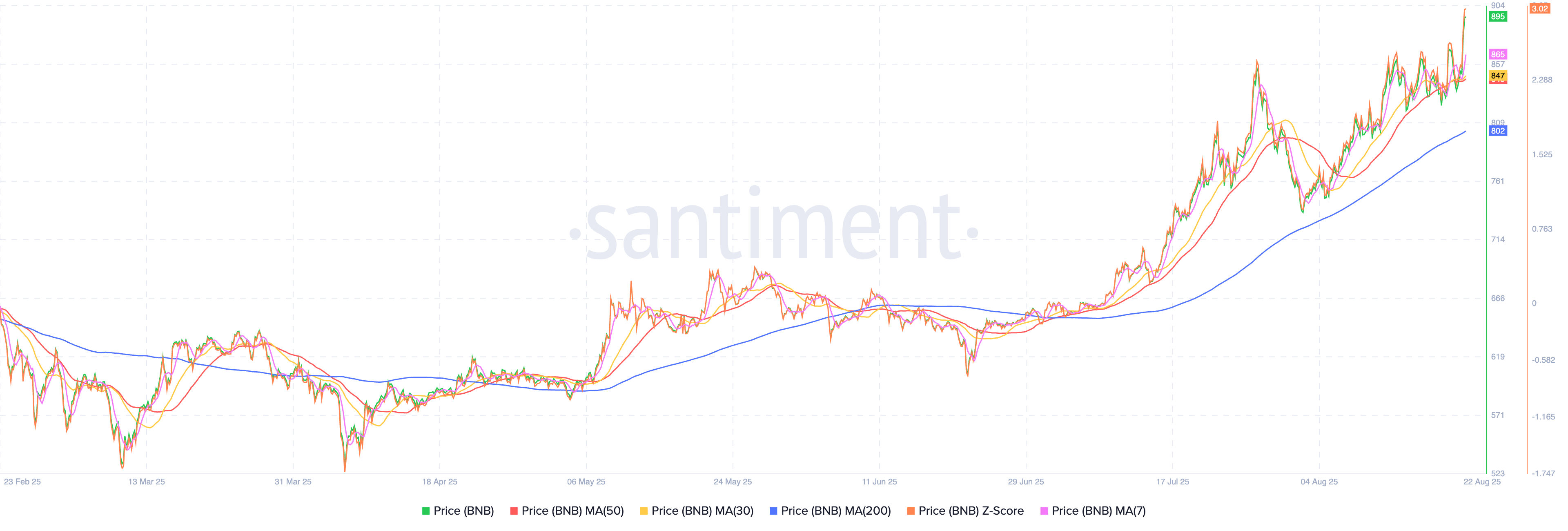

Currently, BNB is trading above all key moving averages, providing a bullish outlook for the token. The 30-day moving average stands at $847.8, while the 50-day average is at $845.2, and the 200-day average rests at $802.8. Notably, the 7-day moving average is at $865, just below the current trading price, indicating a positive short-term trend.

Binance Coin trending upward | Santiment

Technical indicators are overwhelmingly favorable. The MACD is reading at 28.2, surpassing a signal line of 24.8, signaling a bullish crossover. Similarly, the RSI (14) is at 68.45, suggesting a neutral-bullish position, indicating that there is still room for upward momentum before entering overbought territory.

TradingView’s technical dashboard significantly favors buyers, presenting 16 buy signals compared to merely one neutral indication across key oscillators and moving averages.

A critical price level to monitor is $880; many analysts have marked it as a pivotal line. Sustained closes above this level could open opportunities for a potential move toward a 127.2% Fibonacci extension at $923, which was last tested in July 2025. A decisive break could catapult BNB into the $950–$1,000 range in a matter of days.

On the contrary, failing to maintain support at $880 could lead BNB to dip back into the $848–$862 range, with possible downside targets extending into the low $830s if market momentum begins to wane.