The US Spot Bitcoin ETF is making headlines once again, showcasing a significant influx of funds this week, which has coincided with solid gains in Bitcoin (BTC USD) prices. Recent movements in the market have been marked by investor caution, especially following two days of declines last week that sparked a selloff in the broader cryptocurrency landscape. However, new data indicates that institutional investors are regaining confidence in Bitcoin, rallying support for this pioneering digital asset.

This week has seen fund flows into the BTC ETF exceed the $2 billion mark, signaling a renewed interest from big players in the market. Notably, Bitcoin’s price has also shown resilience, crossing the $116k threshold once again, heightening speculation about potential price movements in the near future. As institutional investments pour into Bitcoin, enthusiasts eagerly anticipate a bullish rally for the flagship cryptocurrency.

Let’s delve deeper into the recent developments surrounding the US Spot Bitcoin ETF and explore expert predictions for Bitcoin’s price trajectory.

US Spot Bitcoin ETF Gains Traction With $2B Influx

Data from Farside Investors reveals that the US Spot Bitcoin ETF accumulated a whopping $2.32 billion in fund inflows this week, reflecting a robust re-engagement from institutional investors. Particularly noteworthy was September 10, when daily inflows amounted to $741.5 million, with Fidelity’s FBTC leading the charge with a remarkable contribution of $299 million.

On September 12, inflows remained substantial, totaling $642.4 million, with FBTC and BlackRock’s IBIT contributing $315.2 million and $264.7 million, respectively. Institutions are evidently diversifying their interests, as fund flows into the US Ethereum ETF also registered positive figures this week, amounting to $637.6 million.

What Lies Ahead for BTC Price?

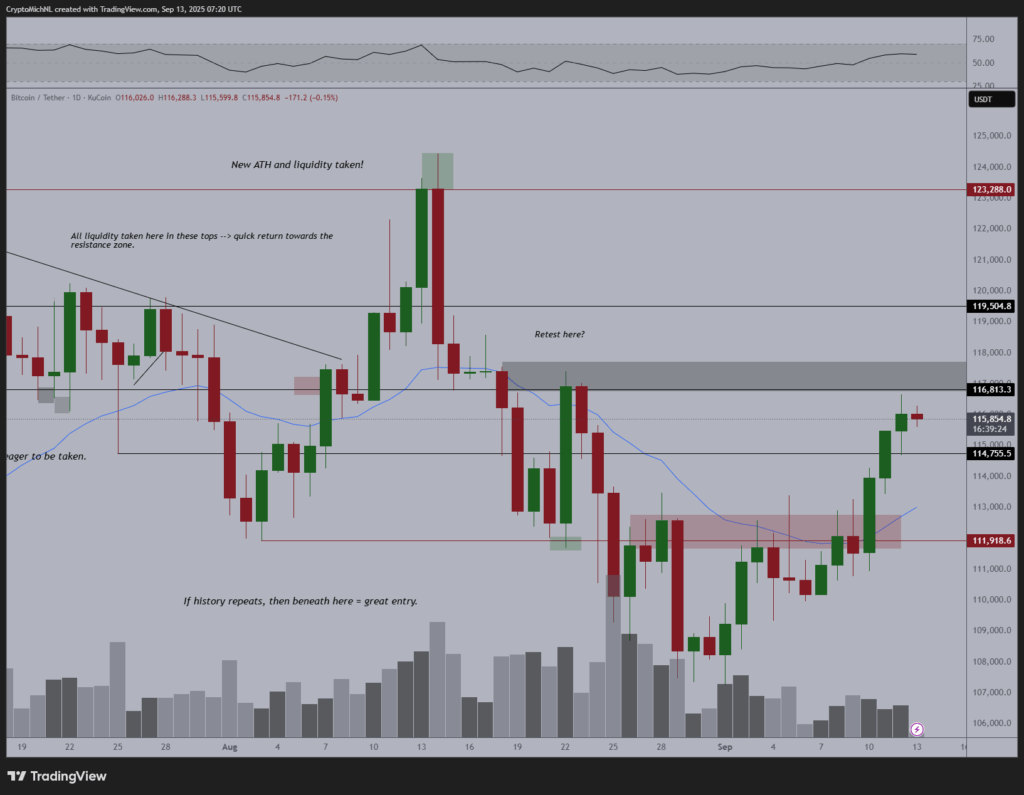

During the past week, Bitcoin’s price shift has been markedly positive, showing an overall increase of approximately 5%, while it recorded a slight decline in the monthly chart. As of now, Bitcoin is trading around $116k, with its 24-hour high registered at $116,769 and a low of $114,794. Despite this uplifting performance, trading volumes have dipped by 5.5% in the last 24 hours, totaling $45.8 billion.

Nonetheless, analysts advise caution as a potential short-term pullback could be in the cards. Michael van de Poppe, a well-known market analyst, highlighted the significance of Bitcoin’s monthly candle in a recent post on X, suggesting it indicates a promising outlook for forthcoming price action. However, he also mentioned that the crypto might experience a consolidation period within its current range. A crucial resistance level lies at $117k, and should Bitcoin successfully breach this mark, there are expectations for it to reach new all-time highs.

Can Bitcoin Price Rally to $250k?

Market expert PlanB has stirred conversation among crypto enthusiasts with his ambitious forecasts for Bitcoin’s price. In a recent post on X, he referred to the Stock-to-Flow (S2F) model, which suggests that Bitcoin could potentially reach up to $500k during the 2024-28 cycle, with predictions ranging from $250k to $1 million. This contrasts sharply with the previous cycle’s predictions, indicating a notable increase in future projections.

In earlier forecasts for the 2020-24 cycle, Bitcoin was anticipated to settle around $55k, yet it closed at $34k, albeit within the expected range. PlanB cautioned that an average below $250k in the current cycle may not bode well for the S2F model’s credibility. Given the current ETF momentum and increased institutional interest, there is a growing belief that Bitcoin could achieve at least $250k in this cycle, which would be a monumental milestone for the cryptocurrency.

As the situation continues to evolve, all eyes remain on Bitcoin and its performance in the backdrop of substantial institutional backing and growing investor enthusiasm.