Yesterday, the cryptocurrency market buzzed as Bitcoin (BTC) faced yet another rejection near the $120,000 resistance level. After a brief surge that peaked at $119,760, Bitcoin has since retreated to a trading price of around $118,900. This recent price movement raises concerns, particularly with the increasing influx of Bitcoin deposits by large holders—often referred to as “whales”—which could exert further downward pressure on the asset.

Binance Whales Ramp Up Bitcoin Deposits

Recent observations from CryptoQuant contributor BorisVest shed light on a notable spike in whale activity on Binance. On July 25, the Binance Whale Inflow metric registered a significant increase, indicating a surge in institutional participants depositing Bitcoin into exchanges. In a single day, the 30-day cumulative inflow to Binance skyrocketed by $1.2 billion, stoking short-term selling sentiment across the market.

This spike in inflows had immediate consequences, with CoinGlass reporting that approximately $141 million in BTC long positions were liquidated in the wake of this inflow surge. This sharp rise in whale deposits suggests a primarily whale-driven selling pressure, despite indications that retail investors have also been moving some of their holdings to exchanges. However, their impact on the market appears relatively muted.

The juxtaposition of increasing whale inflows against a backdrop of rising retail participation has added a layer of instability to Bitcoin’s price. A recent chart highlights that while retail inflows have shown an upward trend, they have not kept pace with the sudden influx from whales, leading to a precarious situation in Bitcoin’s price structure.

This surge in whale inflows coincided with Bitcoin’s rejection at the $120,000 level. Following this setback, Bitcoin retraced to the $115,000–$116,000 range, which has now formed a critical support zone. Analysts have remarked that if this support level fails to hold, a retreat toward the $110,000 mark could become increasingly plausible. Conversely, a robust bounce from this support level could provide another opportunity to test the $121,000 threshold, potentially leading to a new all-time high.

This area is now acting as a short-term support zone. If it fails to hold, a move toward the $110K level becomes increasingly likely. On the other hand, if Bitcoin can bounce strongly from this region, there is still potential to retest $121K and even attempt a new all-time high.

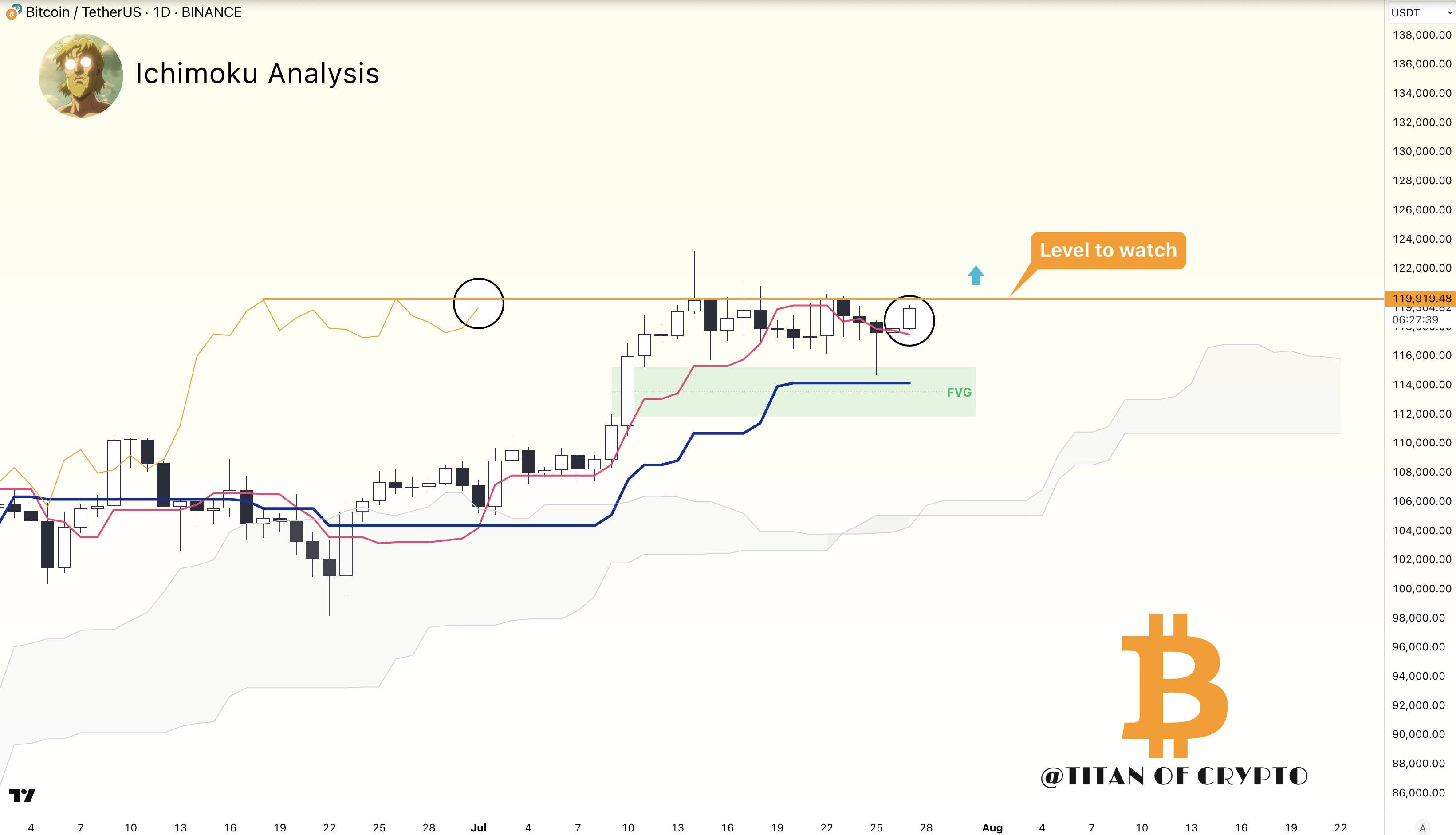

BorisVest pointed out that Bitcoin’s immediate price direction would significantly depend on how well the market absorbs the sell-offs from these whales. Another analyst, Titan of Crypto, noted that a decisive break above the $119,900 level could signal ambitions toward new all-time highs (ATH).

What Else Does Exchange Data Suggest?

While whale inflows pose significant risks, they are not the only factor influencing Bitcoin’s current landscape. Bitcoin reserves on centralized exchanges have recently reached their highest levels since June 25, indicating that some traders might be bracing for a short-term pullback or a consolidation phase before resuming the upward trend.

In contrast, Binance’s share of BTC spot trading volume has also seen a sharp increase recently, suggesting that a market rally may be on the horizon for Bitcoin. As of the latest trading data, Bitcoin is priced at $118,926, reflecting a modest increase of 0.4% over the past 24 hours.