Binance Coin’s Current Price Dynamics

Binance Coin (BNB) is presently at a pivotal juncture, oscillating through crucial price levels that could significantly impact its market trajectory. While the cryptocurrency exhibits robust bullish momentum, it is simultaneously grappling with a critical consolidation phase. This balancing act poses intriguing opportunities and challenges for traders keen on capitalizing on BNB’s potential.

Recent Price Action and Key Indicators

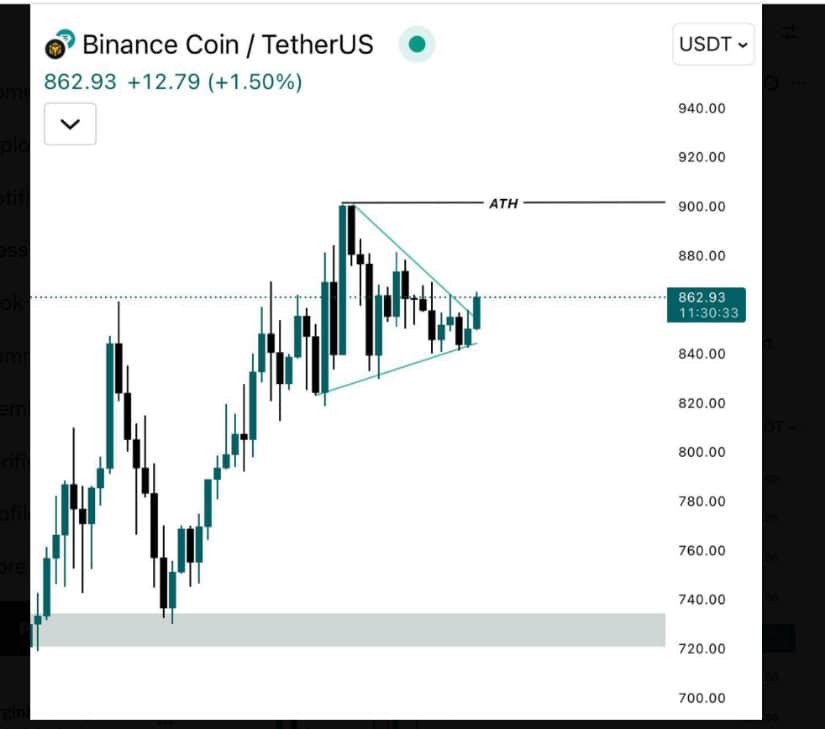

Recent trading patterns indicate a breakout above the monthly open, suggesting that BNB might be gearing up to establish new all-time highs (ATHs). The ongoing price tests against the monthly open have created a solid entry point for traders. With support levels holding firm, the landscape seems favorable for potential gains. However, as the price approaches the $880 resistance level, profit-taking pressure is becoming evident, making the next few days crucial for BNB’s future direction.

Traders are particularly keen on the $860-$875 range, which is becoming increasingly critical as the market swings between upward momentum and consolidation. Notably, rising buying interest could see Binance Coin ambitiously aim for the $1,000 mark. Nevertheless, traders must remain vigilant for breakout or pullback signals that could illuminate the asset’s short-term paths.

Analyzing BNB’s Price Action

Observing BNB’s price action reveals a notable consolidation near the $860 level. Following its recent surge above the essential monthly open, BNB seems trapped between buyer enthusiasm and profit-taking that stifles further upward movements. The retest of the monthly open strengthens the breakout’s validity, suggesting the emergence of continued bullish interest.

Staying above the monthly open, the price resilience signals the potential for further upward movement. However, the repeated resistance at the $880 mark presents a significant barrier. Analysts identify this resistance as key for BNB to navigate toward the sought-after $1,000 target.

Support and Resistance Analysis

A close examination of the support and resistance levels reveals the $860 region acting as a robust support zone. The price has shown an ability to rebound consistently from this level during recent fluctuations, making it critical for sustaining the bullish outlook. A consistent hold above this threshold could catalyze movements toward even higher price levels.

On the flip side, the $880 resistance stands as a pivotal threshold that BNB must clear to sustain its upwards trajectory. As selling pressure continues near this level, traders will be closely monitoring for a breakout or a dip. Significant transactions occurring close to the $880 mark could indicate that sellers are positioning themselves, potentially stalling upward momentum unless buying pressure escalates.

Market Sentiment and Trading Volume Trends

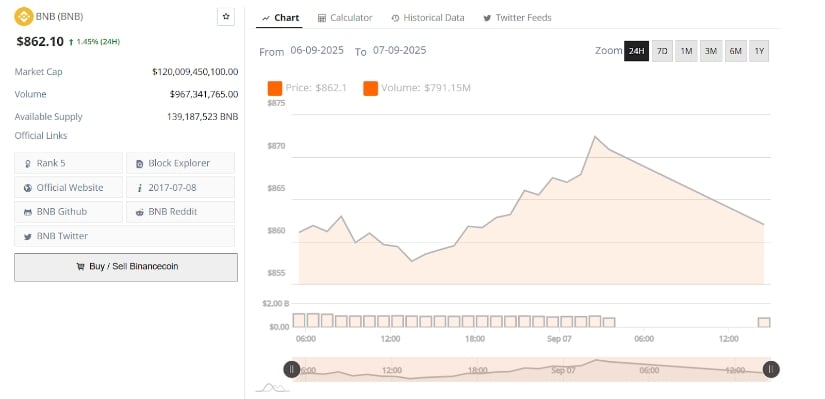

The prevailing market sentiment surrounding Binance Coin remains optimistic, evidenced by the increasing bullish momentum and corresponding trading volumes. On September 6-7, 2025, BNB experienced a notable price surge, reaching above $875 before correcting back to the $860 level.

During this spike, trading volume peaked around $2 billion—an indication of robust market interest. Despite the subsequent retracement, the overall trend suggests that buyers remain active, eagerly looking for the next directional movement. The dynamics of volume and price action illustrate a market gradually gaining confidence in the bullish trend, yet profit-taking has led to short-term corrections.

Insights From Analysts

Crypto analysts are closely watching BNB’s current consolidation between the $840-$880 levels. One key observer, Analyst Cipher X, emphasizes this range, noting that support at $840 has effectively prevented further price declines, while resistance at $880 serves as a major hurdle.

The outlook for BNB heavily hinges on the engagement between buyers and sellers within this range. A breakthrough above the $880 resistance could set the stage for a thrilling journey towards new highs, while failure to hold the $860 support could lead to deeper consolidation or another pullback.

Conclusion

Overall, Binance Coin’s current price dynamics embody a classic tale of opportunity and caution. As it navigates crucial support and resistance levels, traders are poised at the edge, ready to respond to the unfolding narrative of this vibrant cryptocurrency. The next days will surely be a decisive chapter in Binance Coin’s ongoing story.