Binance Coin (BNB) has recently demonstrated impressive growth, showcasing a solid 4x increase from $217 to $861. This strong upward movement positions BNB as one of the most stable and resilient cryptocurrencies in the market. Despite the volatility typically seen in digital assets, its consistent growth reflects investor confidence in its long-term value and stability.

With recent price action showing a 1.39% increase in the past 24 hours, BNB has been trading around $807.32. The coin has reached key support levels, pushing toward critical resistance zones around $1,500 to $1,700. Analysts note that the continued upward momentum makes it a valuable asset to watch closely.

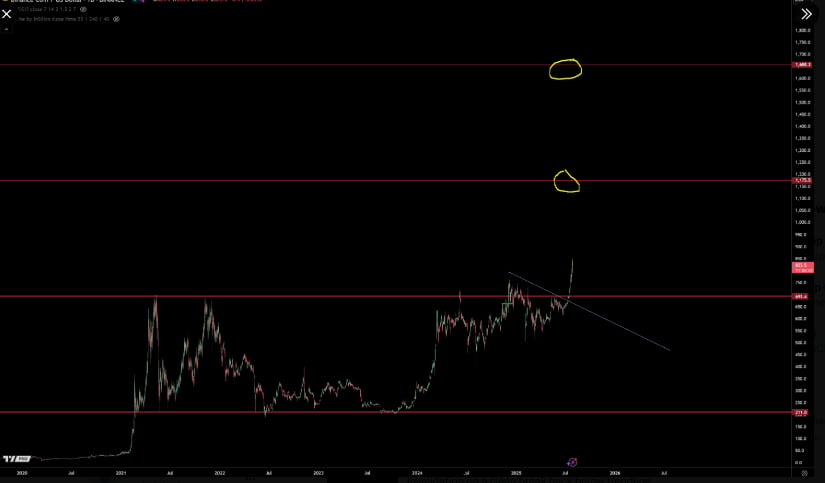

Binance Coin Sees 4x Growth as Traders Eye $1,700 Resistance Zone

Recently, Binance Coin (BNB) has experienced a substantial rally, marking a remarkable 4x increase from $217 to $861. Analyst Crypto GVR highlighted this impressive surge as demonstrating BNB’s resilience and stability, especially in a market often characterized by chaos and unpredictability.

Source: X

As of now, with its current price hovering around $807, BNB has shown a 1.39% increase over the last 24 hours. A high of $819.44 and a low of $794.75 indicate that while fluctuation is part of the game, it doesn’t significantly undermine the overall upward trend. The resilience and trend suggest burgeoning investor confidence.

BNB Trading Volumes and Stability

BNB’s recent price actions are reinforced by solid trading volumes, with over $1.2 billion in 24-hour trading activity. This robust market engagement indicates significant participation from both retail and institutional investors. High trading volumes signal a growing belief in the coin’s long-term stability and value. Despite the temporary volatility, the overall trend remains bullish and encouraging for potential investors.

Source: BraveNewCoin

The uptick in trading volume shows that market participants are actively involved, reinforcing BNB’s position as a leading cryptocurrency. Such engagement suggests that holders are likely to continue trading or maintaining their assets, contributing to its stability moving forward. Notably, the market capitalization has recently reached approximately $113 billion, solidifying BNB’s significance in the digital asset landscape.

Resistance Levels Near $1,700

Market analysts have noted that BNB is approaching critical resistance levels, specifically around $1,500 and $1,700. TraderSZ has emphasized that these zones are essential indicators for the coin’s future price action. Successfully surpassing the $1,700 mark could indicate the potential for further bullish trends; however, maintaining momentum will be crucial for this ascent.

Source: X

The chart from TraderSZ illustrates that trading around these resistance points will be pivotal for many investors. A continued ascent above these prices could invigorate bullish sentiment across the market, while an inability to break through might result in consolidation periods or potential reversals, closely tied to overarching market trends.

Binance’s Influence on BNB Performance

The price movements of BNB are closely linked to the performance of its parent company, Binance. Analyst TraderSZ has pointed out that the trajectory of BNB is often reflective of decisions made by Binance CEO Changpeng Zhao (CZ). The recent bullish rally suggests collective confidence in Binance’s role in the global crypto ecosystem.

Future price movements for BNB will hinge heavily on the company’s market standing and ability to adapt to shifting dynamics within the cryptocurrency landscape. The intertwined relationship between Binance and BNB underscores how operational decisions can shape the coin’s value and impact investor sentiment.