In the ever-evolving landscape of cryptocurrency, Bitcoin (BTC) continues to captivate the attention of investors and analysts alike. Since reaching a new all-time high in January, Bitcoin has struggled to regain its bullish momentum, entering into a downtrend that has endured for over two months. Renowned market analyst Egrag Crypto suggests that this prominent cryptocurrency may remain in a corrective phase for several months before it can trigger the next significant price rally.

Bitcoin’s 231-Day Cycle Hints At $175,000 Target By September

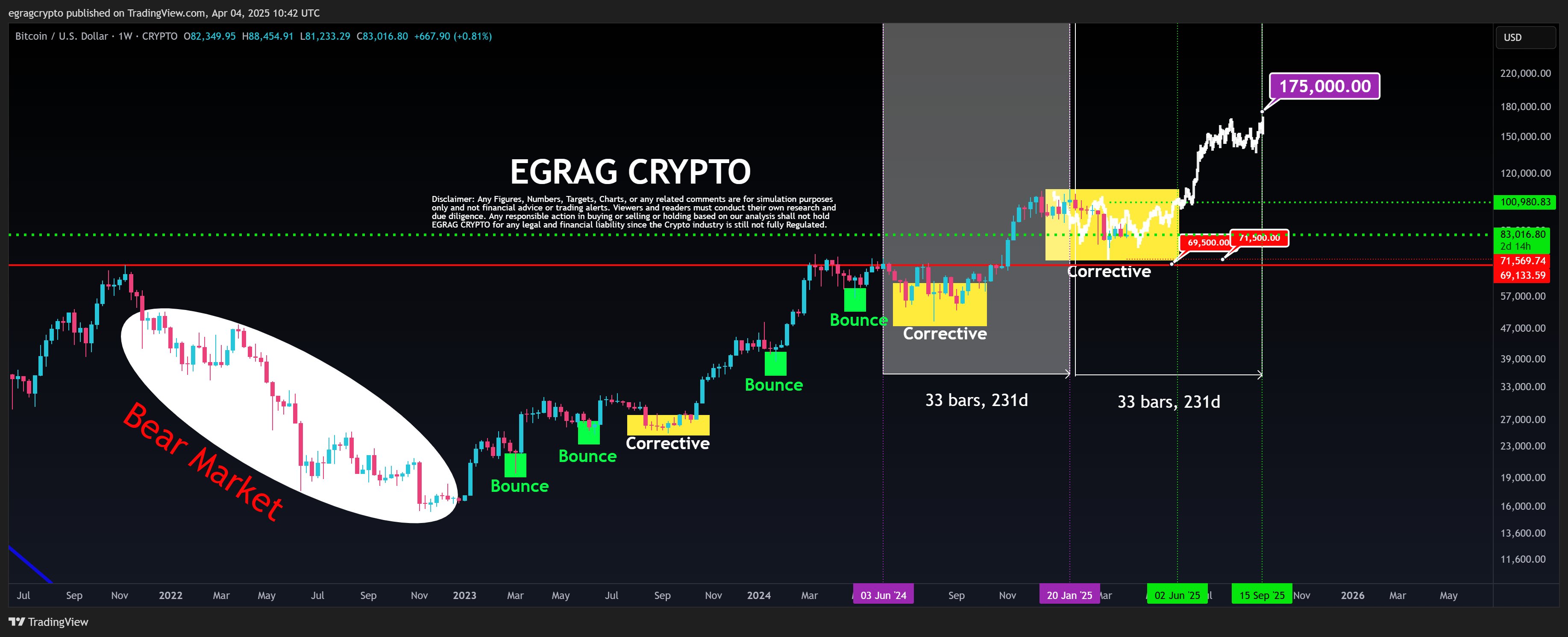

Egrag Crypto’s analysis points to an intriguing cycle within the Bitcoin market. Following the initial price decline in February, he speculated that Bitcoin might face corrections due to a CME gap before rebounding. However, the lack of robust bullish indicators over the last few weeks has led him to conclude that Bitcoin is currently entrenched in what could be a protracted corrective phase.

In a recent update, Egrag identified that Bitcoin’s ongoing correction aligns with a fractal pattern, a recurring price structure evident across various timeframes. This analysis is grounded in a notable 33-bar (231-day) cycle during which Bitcoin transitions from a corrective state to an explosive price surge. The potential implications of this cycle are significant—if historical patterns hold, Bitcoin could break out of this recalibration phase by June and aim for an impressive market top of $175,000 by September. Such a forecast would represent an astounding 107.83% increase on current prices.

However, market participants are advised to remain cautious. To ignite this anticipated price rally, it is critical for market bulls to achieve a breakout above the substantial resistance level at $100,000. Conversely, a drop below the established support range of $69,500 to $71,500 could undermine this bullish outlook and possibly signal the conclusion of the current uptrend.

BTC Investors Wait As Exchange Activity Slows Down

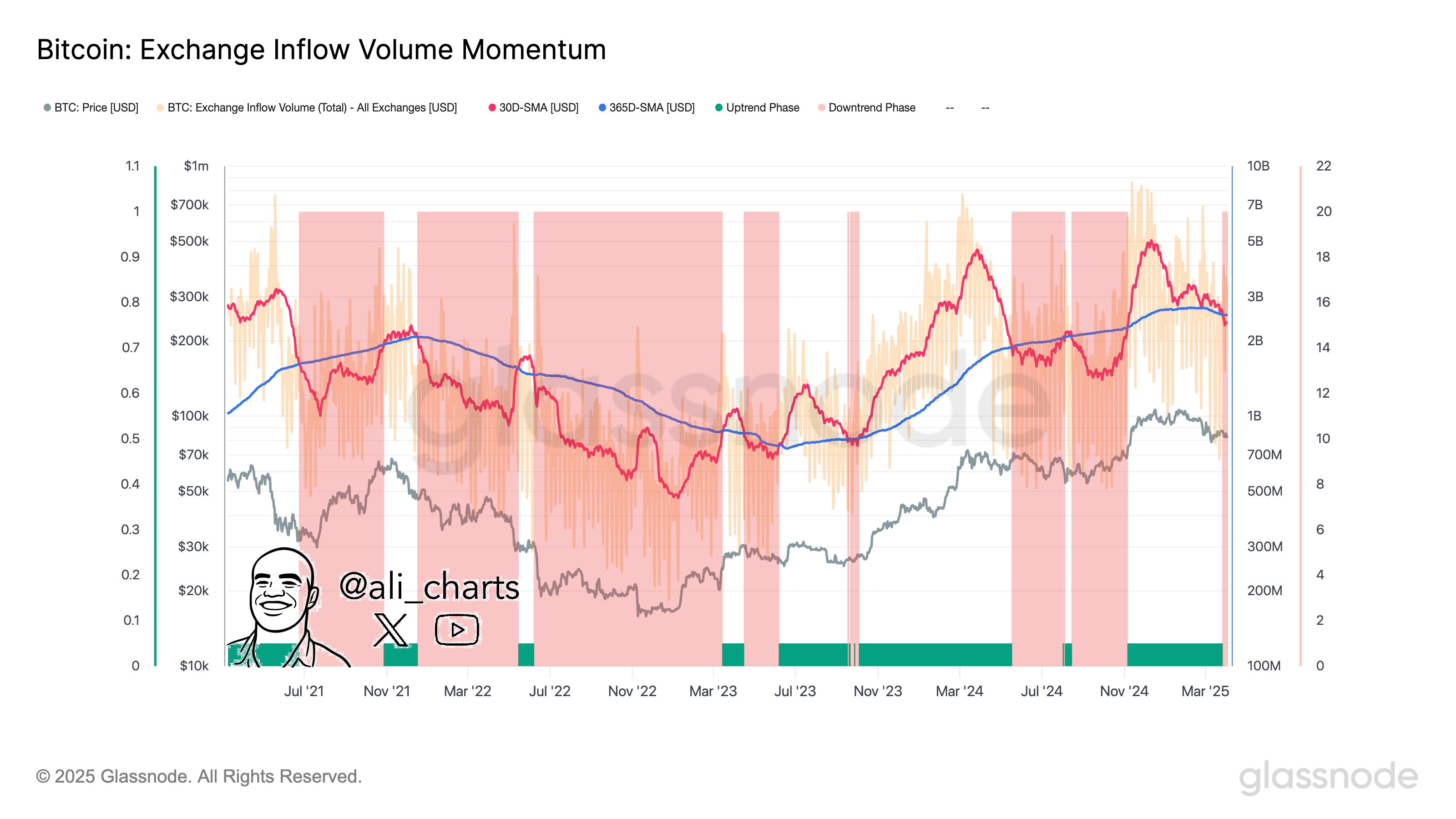

Amidst these speculative forecasts, there is a notable trend of decreased activity on Bitcoin exchanges. Expert Ali Martinez has reported a decline in exchange-related activity, which suggests a general hesitation among investors regarding the immediate future of Bitcoin. This slowdown in network utilization indicates that many investors are pausing deposits and withdrawals as they grapple with market uncertainties.

Martinez indicates that a trend shift is likely on the horizon for Bitcoin as participants await a market catalyst that could influence price movements. It is noteworthy that despite the recent imposition of new tariffs by the US government on April 2, Bitcoin exhibited remarkable resilience. Data from Santiment reveals that BTC’s price only dipped by 4% in the hours following the announcement, showcasing a significantly milder reaction compared to past instances where tariff news impacted the market harshly.

Since that announcement, Bitcoin has managed to regain some ground, currently trading at approximately $83,805. Investor interest remains strong, with recent data showing a $5.16 billion inflow into the crypto market over the past day, alongside a notable 26.52% increase in Bitcoin’s trading volume, which currently stands at a robust $43.48 billion.

Featured image from UF News, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.