XRP’s recent price surge signals a significant shift in investor interest within the cryptocurrency landscape. After weeks of consolidation, the altcoin is navigating new highs, aligning with the broader bullish momentum observed across the market.

XRP Faces Danger

As XRP prices ascend, the specter of a technical death cross looms over the daily charts. The convergence of the 50-day exponential moving average (EMA) with the 200-day EMA is a critical signal. When the shorter-term EMA crosses below the longer-term EMA, it traditionally indicates increasing bearish pressure and potential trend exhaustion.

However, the current market context is important. Since November 2024, XRP has been enjoying a robust bullish structure marked by a Golden Cross. This 14-month period of upward momentum suggests that while the EMAs are narrowing, the recent price rally might mitigate the immediate risk of a death cross. Investors are likely weighing their decisions carefully at this juncture.

For more insights penned by Editor Harsh Notariya, consider signing up for the Daily Crypto Newsletter here.

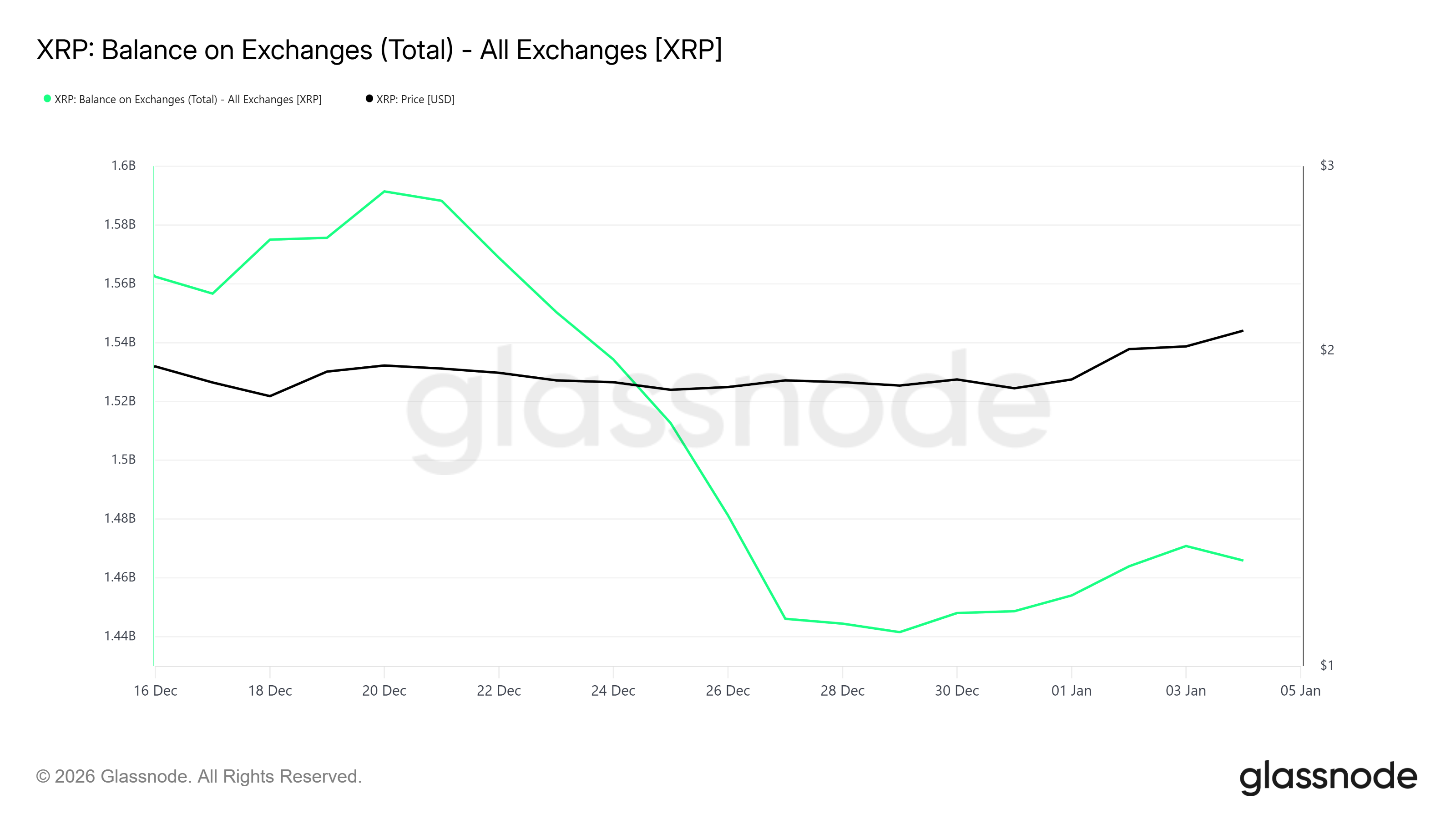

On-chain metrics present a resilient picture of investor behavior, particularly amid rising prices. A close look at exchange balance data reveals only a modest amount of selling activity. Over the past six days, around 24 million XRP, which translates to approximately $51 million, found their way to exchanges. This limited selling aligns with XRP’s price recovery, demonstrating a relatively stable selling environment.

Considering that the price has increased by 16% during the same period, the data indicates that holders are exhibiting restraint. When fewer tokens are available for liquidation, this often helps in stabilizing the price. The balance between buying and selling activity is crucial for the maintenance of upward momentum.

XRP Price Rise Is Solid

Currently trading near $2.14, XRP has experienced a striking 16.5% gain over the past 24 hours, successfully breaking through the $2.00 threshold. This upward movement is fueled by improved sentiment among investors and restrained selling pressure observed in spot markets across the board.

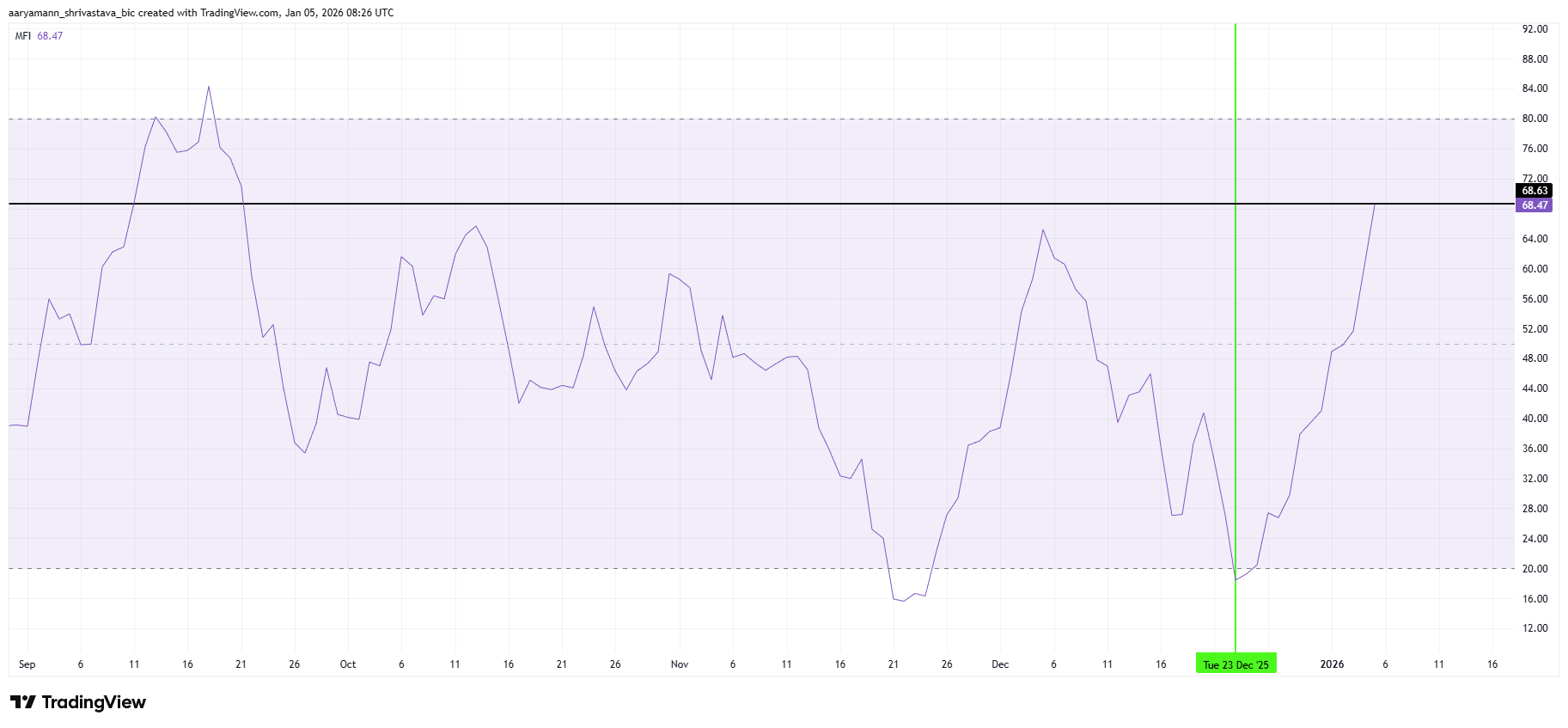

Moreover, key momentum indicators further support the bullish outlook for XRP. The Money Flow Index (MFI) has reached a peak not seen in three and a half months, remaining well above the zero line. The MFI assesses the buying and selling pressure relative to price and volume, and its ascent alongside price movements confirms a demand-driven strength rather than mere speculative spikes.

If the current momentum maintains its strength, XRP could target gains up to $2.20, with resistance seen around $2.31. It’s crucial to note, however, that this bullish trajectory hinges upon sustained confidence from investors. A sudden shift towards selling could easily compress prices back toward $2.03 or potentially below the critical $2.00 mark, reviving concerns about a death cross.