Ethereum (ETH) is currently eyeing a vital resistance level near $3,100, and market analysts speculate that a decisive breakout could spark a fresh wave of upward momentum. Predictions are already surfacing, with targets soaring as high as $5,000 for this leading cryptocurrency.

After recently oscillating below the $3,000 mark, Ethereum is displaying signs of renewed activity in the crypto market. Traders are keeping a close eye on trend support at approximately $2,900, while the impending Fusaka upgrade promises enhancements in network efficiency and transaction processing. Such upgrades can often set the stage for substantial price moves.

Ethereum Faces Key Resistance Levels

In the past week, Ethereum’s price has lingered around the $3,018 mark, facing resistance in the $3,100–$3,200 range. According to TradingView analyst CryptoTrendX, who specializes in multi-year trend analysis, Ethereum is firmly anchored above trend support near $2,900. This trend support reflects historical price levels where buyers have previously stepped back into the market, potentially staving off deeper price declines.

A confirmed breakout above the $3,100 resistance, paired with robust trading volume and a daily close, could signal the advent of a bullish phase for Ethereum, with an initial price target set near $5,000. Source: MMBTtrader on TradingView

According to CryptoTrendX, “A decisive move above $3,100 may pave the way for bullish activity reaching $5,000, following measured-move projections derived from recent consolidation patterns.” Measured moves are a technical analysis tool that estimates potential price targets based on previous price fluctuations.

Recent Market Sentiment and Holder Activity

Ethereum witnessed a brief pullback recently, dropping around 6% to $2,805. However, Glassnode’s on-chain metrics reveal that long-term holders (LTHs)—those who have held ETH for 2–3 years—have reduced their circulating share from 8.51% to 7.33% since early November. Historically, LTHs have acted as stable market participants, and any reduction in their holdings could impact price stability.

Despite the decrease in long-term holders, the number of new Ethereum addresses has surged by 13.4% over the past week, climbing from 141,650 to 160,690. This uptick in new addresses may signal fresh investor interest, which could counterbalance the declining participation from LTHs.

Technical Analysis and Price Targets

According to technical charts from TradingView and CryptoQuant data, the following key levels have emerged:

- Support Levels: $2,718, $2,780, $2,850

- Resistance Levels: $3,030, $3,095–$3,100

Bullish Scenario:

- ETH may find trend support, attempting to break into higher levels.

- Initial targets include $3,030, with a potential upward move towards $3,095–$3,100.

- A sustained break above $3,100 could trigger bullish momentum towards $5,000, contingent on volume and trend confirmation.

Ethereum has rebounded from $2,718 and currently sits above $2,850, setting the stage for a bullish push towards $3,030–$3,100, while any drop below $2,850 risks a reversal towards the $2,780–$2,718 range. Source: Elise-Golden-Spar on TradingView

Bearish Scenario:

- If ETH fails to hold the $2,850 support, short-term prices may sway toward $2,780 or $2,718.

- Historical analysis indicates that Ethereum often experiences heightened volatility near key resistance and support levels, particularly with forthcoming network upgrades.

Ethereum Outlook Amid Upcoming Fusaka Upgrade

The Ethereum Foundation has outlined plans for the Fusaka upgrade in December 2025, targeting improvements in transaction throughput, latency reduction, and gas fee optimization. While these enhancements may drum up positive market sentiment, it’s essential to recognize that the market responses to network upgrades can often be staggered or delayed.

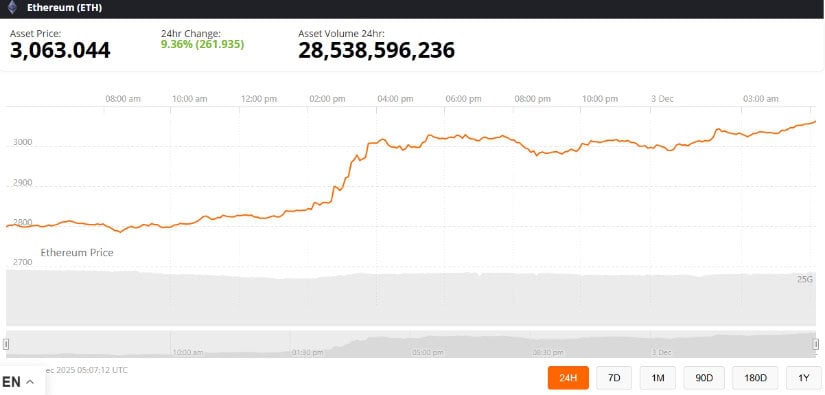

Ethereum was trading at approximately $3,063.04, reflecting a 9.36% increase in the last 24 hours. Source: Ethereum price via Brave New Coin

Analysts emphasize that while favorable technical indicators point to potential bullish behavior, external factors, including macroeconomic trends, ETF inflows, and broader market dynamics, could significantly influence market behavior. Historical patterns assert that significant upgrades coupled with breakthroughs at resistance points often yield notable price volatility.

Looking Ahead: Ethereum Price Forecast

After analyzing Ethereum’s recent price movements, it’s evident that breaching the $3,100 resistance level could spark renewed upward momentum, with near-term technical targets hovering around $3,030 and longer-term aspirations reaching up to $5,000. Conversely, failure to maintain trend support near $2,850 could incite short-term price fluctuations downward.

For enthusiasts following Ethereum’s journey today, keenly observing network activity, resistance and support levels, and shifts in investor engagement is crucial in anticipating future market movements—though these indicators should not be mistaken for guaranteed outcomes.